Planning for Retirement: How Much Do I Need?

Three things in life are certain; everyone dies; there will be taxes to pay and flat roofs leak!

Knowing from the start that you cannot avoid getting old, you would have thought that we as humans would be good at planning for retirement because it is such a well-trodden path; but nothing could be further from the truth. Speaking from my own experience, as I write this, fast approaching the autumn of my years, I have realised something important; I have no idea how much I need in my pension pot to ‘have a good retirement’.

Having decided to investigate, I share with you here, my findings; in the hope that it helps you, or someone you know, start planning earlier and to know with more certainty what is a good plan for retirement.

Before I start, I should point out that Monetta are Chartered Accountants, we are not Financial Advisers and therefore, we need to tread with care. This newsletter is not financial advice, it is a generic newsletter intended to provoke thought and maybe action. However, before actioning anything, you should seek professional financial advice

Pensions

Hargreaves Lansdown defines a pension as “a long-term investment plan that you typically build up over your working life. It is designed to provide you with an income when you retire or decide to stop working.”

There are many different types of pensions, and they, and the rules that govern them can be very complex, which is why you should always get professional financial advice. I do not intend to go through the types of pensions or the complex rules here; but I do want to highlight a few things that I think you should understand and point out what you can do to influence the overall size of your pension pot before you retire.

What factors influence the size of my pension pot?

- Amount Invested: The more money you contribute to your pension fund, (potentially) the larger your pension pot will be.

- Investment Performance: The performance of your investment fund can significantly impact the size of your pension pot. If your investments perform well, your pension pot will grow. Conversely, poor performance can reduce its size.

- Retirement Age: The age at which you decide to start drawing your pension can also affect its size. The longer your money remains invested, the more potential it has to grow.

The amount you choose to invest is subjective, so is the date that you choose to retire. Investment performance cannot be controlled but my ‘takeaway’ is simply: the more you put in and the longer you give it to grow, the bigger your pension pot will be.

Compounding

Compounding is the process in which an asset’s earnings are reinvested to generate additional earnings over time. This growth occurs because the investment will generate earnings from both the initial amount invested and the accumulated earnings over time.

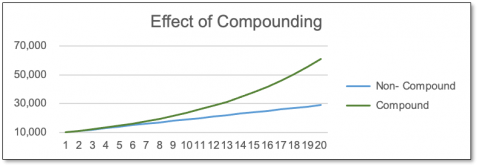

Below, is a visual representation of the effects of compounding. The blue line depicts £10k invested over 20 years with a 10% flat return, i.e. £1k per year. The green line represents the same 10% growth, but each year, as the pot gets bigger, so does the incremental growth. Same investment, same time frame, one results in £30,000 the other in £67,275.

So, the moral of the story from my point of view is that compounding is super powerful and that means, we should all start paying in to a pension sooner rather than later.

But how big does it have to be?

Some say “the bigger the better” but how big should it be as a minimum? Only you can know, but thankfully, PLSA have attempted to answer it for us. To explore this in detail you should visit (https://www.retirementlivingstandards.org.uk) but below, are their headline findings.

|

How much will I need each year in retirement? |

||

|

Living Standard |

One-person |

Couple |

|

Minimum |

£14,400 |

£22,400 |

|

Moderate |

£31,300 |

£43,100 |

|

Comfortable |

£43,100 |

£59,000 |

To put this in context, the combined pension pot of the couple who want to live comfortably, i.e. plan to be able to spend £59,000 per year, based on current life expectancies and annuity rates, Nucleus Financial have calculated their combined pension pots would need to be £870,000!

For a printable version of this article, please click here.

Contact Us

To find out how we can help please call us or complete an enquiry form.

Visit our team page to find out more about our expert advisers.